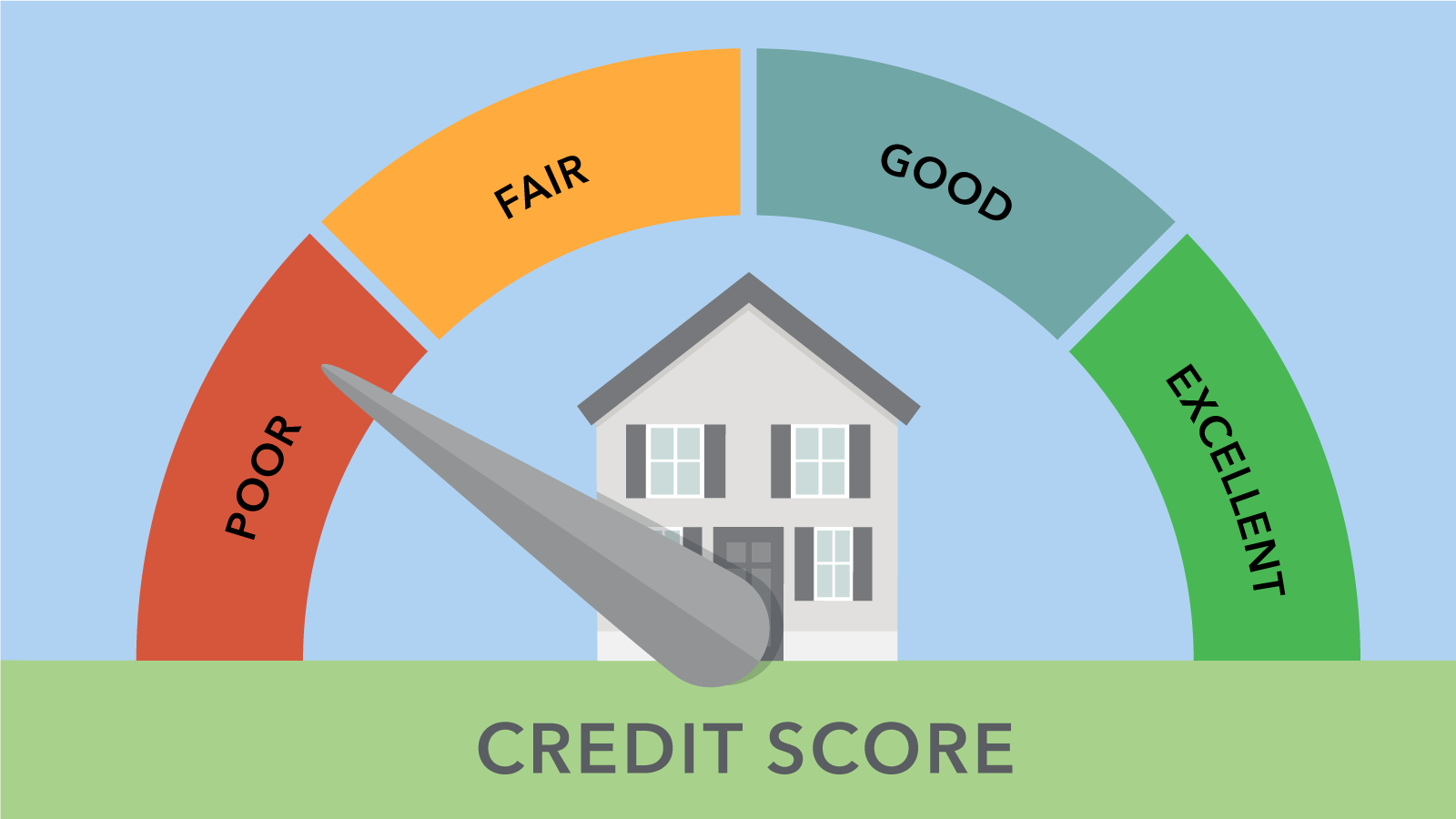

What is a Credit Score?

Understanding your credit score in Dubai is essential for both newcomers and long-term residents, as it plays a critical role in accessing financial products like loans and credit cards. Your credit score serves as a comprehensive representation of your financial behavior, including your borrowing history, payment punctuality, and overall financial management. Lenders in the UAE rely on this score to evaluate your creditworthiness, which can significantly influence their decision to grant you credit.

For those new to Dubai, checking your credit score is a straightforward process. You can use your bank’s mobile application or visit the Al Etihad Credit Bureau (AECB) website. Simply log in with your Emirates ID, and while the first report may come with a nominal fee, it’s a small investment in understanding your financial health. For current residents, regularly monitoring your AECB credit score can uncover insights into your financial habits and highlight areas for improvement.

Maintaining a good credit score is not just about securing loans; it can also lead to lower interest rates and better terms. In Dubai’s competitive financial landscape, a strong score can open up opportunities for more favorable mortgage rates or car financing options. By being proactive in managing your finances and staying informed about your credit standing, you can enhance your financial future in this vibrant city. Additionally, a good credit score reflects reliability as a borrower, making it easier to access loans, credit cards, and rental agreements.

Why it Matters?

Understanding the significance of your credit score is vital for both newcomers and long-term residents in Dubai. Your credit score is more than just a numerical value; it represents your financial credibility, which plays a crucial role in various aspects of living in the UAE.

Firstly, having a robust credit score simplifies loan approvals. Whether you’re looking to finance a car or secure a personal loan, a higher score increases your chances of approval, which is particularly important in a competitive market like Dubai. Furthermore, a good credit score often translates into lower interest rates, which can save you significant amounts over time, especially with the ever-increasing cost of living in the emirate.

Additionally, if you’re considering renting, landlords frequently assess credit scores to determine tenant reliability. A strong score can set you apart in a bustling rental market, helping you secure your ideal home in neighborhoods like Dubai Marina or Downtown Dubai. Lastly, being aware of your credit score empowers you to manage your finances more effectively, allowing you to plan and budget for major purchases with confidence. Moreover, understanding your KHDA ratings can also influence your family’s educational choices, providing insights into the quality of schools in the area.

How to Check your Score Online?

Checking your credit score is an essential step for anyone living in Dubai, whether you’re a long-term resident or a newcomer planning your financial future. For a nominal fee of Dhs10.50, you can access just your score, or opt for a comprehensive report at Dhs84. This allows you to stay informed about your credit status, which is crucial when applying for loans or renting properties.

Once the payment is processed, your score will be delivered instantly in a PDF format, making it both efficient and convenient. Regularly monitoring your credit score can help you make informed financial decisions, from optimizing mortgage options to evaluating potential investment opportunities in Dubai’s competitive real estate market. Additionally, understanding your credit score can enhance your banking experience by allowing you to qualify for better financial products and services.

Moreover, understanding your credit score can also impact your everyday expenses, such as insurance premiums or utility deposits. By dedicating just a few minutes today to check your score, you can gain valuable insights into your financial standing, potentially uncovering areas for improvement that could lead to better rates and terms in the future.

Check Through Your Bank

Checking your credit score through your bank is a practical step for both new and long-term Dubai residents, as it provides insights into your financial health. Many banks in the UAE now offer this service seamlessly through their mobile apps, allowing for quick and often cost-free access.

To begin, log into your bank’s app using your secure credentials; this is crucial for safeguarding your financial information. Next, navigate to the credit score feature, typically found in the app’s main menu, making it easy to locate. Once there, follow the guided prompts; these are designed to walk you through the process without confusion. After accessing your score, take the time to review and analyze its implications. Understanding your credit score is essential as it can influence loan approvals and interest rates, which is particularly pertinent for those considering property investments in Dubai. This is especially important for non-resident bank accounts, as banks may evaluate your creditworthiness differently based on your status.

Apps

For Dubai residents keen on monitoring their credit scores, leveraging apps designed for this purpose can provide significant advantages. One noteworthy option is TAMM, which allows users to log in seamlessly using their UAE Pass. With this app, you can access your credit score in real-time—an invaluable tool for those looking to make informed financial decisions.

On the other hand, the DubaiNow app also stands out as a user-friendly alternative. After a simple download and sign-in process, users can obtain their credit score instantly. This immediacy can be particularly beneficial for residents who are considering loans or rental agreements, as understanding your credit status is crucial in these scenarios.

Both apps not only streamline the process but also empower residents to take charge of their financial health. Staying informed about your credit score can lead to better financial management and planning, ensuring you are well-prepared for any future financial commitments. Thus, utilizing these resources is a smart decision for maintaining your financial well-being in Dubai. Additionally, understanding financial stability is essential when applying for various types of UAE visas, which often require proof of sufficient funds.