Calculating end of service gratuity in line with UAE Labour Law involves understanding eligibility, determining salary, and applying the correct formula. Knowing the rules can help you maximize your benefits and guarantee compliance. If you’ve served less than a year, you won’t receive gratuity. For those with longer tenures, the calculation changes considerably. What steps do you need to take to make sure you’re receiving the correct amount? Let’s explore the details further.

What End of Service in the UAE

End of service in the UAE refers to the benefits employees receive when their employment ends, regardless of resignation, termination, or contract completion. Understanding these benefits is vital for you as an employee in the UAE.

The end-of-service benefits typically include gratuity payments, which are calculated based on your final basic salary and the duration of your service. Additionally, you’ll be entitled to any unpaid wages and compensation for unused annual leave.

These UAE benefits guarantee you receive fair compensation upon leaving your job. The calculation of gratuity differs based on your length of service, and it’s essential to know how it works to avoid any discrepancies.

Employers must settle all end-of-service payments within 14 days of your last working day. Familiarizing yourself with these aspects will help you navigate your rights and entitlements effectively when your employment comes to an end.

Who Is Eligible for Gratuity?

To qualify for gratuity in the UAE, you must have completed at least one year of uninterrupted service with your employer.

Understanding the gratuity eligibility criteria is essential for all employees, including expatriates. Regardless of if you’re a full-time, part-time, or flexible worker, if you meet this one-year requirement, you’re entitled to gratuity upon termination of your employment.

Expatriate employee rights are specifically protected under UAE Labour Law, ensuring you receive your rightful gratuity benefits.

It’s significant to mention that gratuity calculations are based on your last basic salary and duration of service, excluding allowances like housing and transport.

Gratuity Calculation in UAE

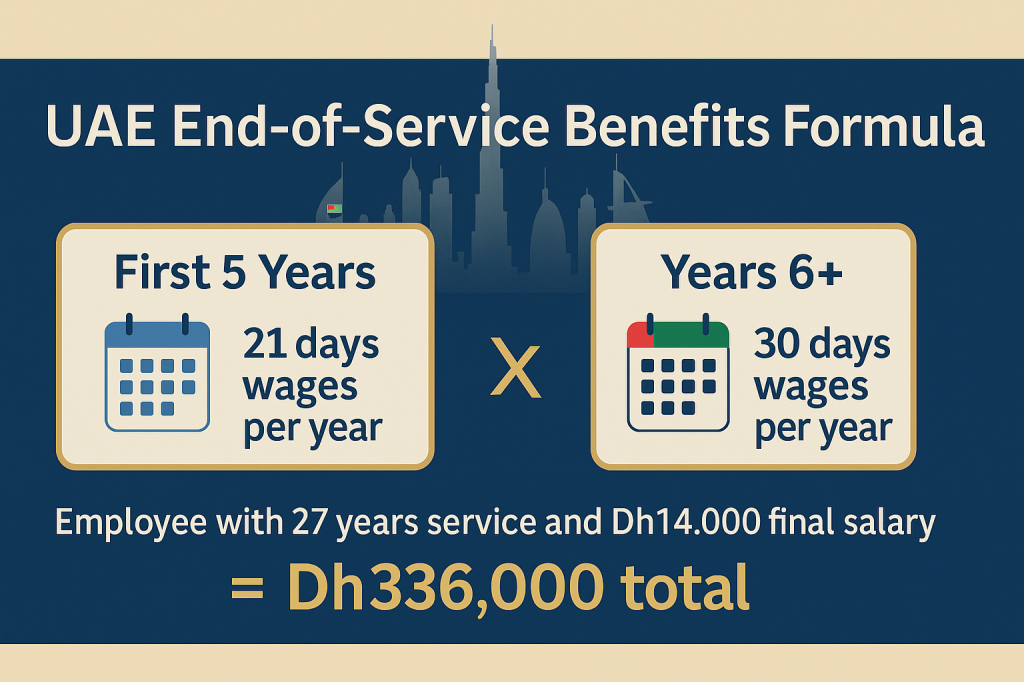

Once you’ve established your eligibility for gratuity, understanding how it’s calculated is crucial. Gratuity calculations in the UAE depend on your final basic salary and your length of service. Here’s a quick reference:

| Duration of Service | Gratuity Rate | Calculation Basis |

|---|---|---|

| Less than 1 year | No gratuity due | N/A |

| 1 to 5 years | 21 days’ basic salary | Total years served |

| Over 5 years | 30 days’ basic salary | Each year beyond five |

To avoid gratuity disputes, verify your calculations are accurate, factoring in that unpaid leave days are excluded. Remember, the total gratuity must not exceed two years’ salary. If you have questions or need assistance, seeking legal advice can help clarify any uncertainties regarding your entitlements.

Rules of Gratuity Entitlement in the UAE

Understanding the rules governing gratuity entitlement in the UAE is essential for employees planning their exit from a job. To qualify for a gratuity payment, you must have at least one year of uninterrupted service. The calculation method is based on your final basic salary, excluding allowances.

For the first five years, you’re entitled to 21 days’ salary for each year of service. Beyond five years, this increases to 30 days’ salary for each additional year.

Employers are required to settle gratuity payments within 14 days of your last working day, and they can deduct any outstanding financial obligations you may have.

If you’re working part-time or on a flexible contract, the gratuity is calculated proportionally based on your working hours. Always confirm that your employer follows these regulations to guarantee you receive what you’re entitled to.

Final Settlement According to UAE Labour Law

When your employment ends, it’s important to know what constitutes a final settlement under UAE Labour Law.

The final settlement refers to the total financial package owed to you, and it includes several components. First, make sure you receive any unpaid salary up to your last working day.

Next, you’ll be entitled to your gratuity payout based on your service duration, along with compensation for any unused annual leave. Additionally, outstanding bonuses, commissions, or performance incentives should also be part of your final payments.

Reimbursable expenses may be included as well. Under UAE Labour Law, your employer is required to settle all entitlements within 14 days of your final working day.

If you owe any money to your employer, those amounts can be deducted from your final settlement, but this must be clearly communicated to uphold your employee rights.

Legal Support for End-of-Service Cases in UAE

As you navigate the complexities of end-of-service matters in the UAE, having access to legal support can be invaluable. Engaging with legal consultants guarantees you understand your rights and obligations under the UAE Labour Law, particularly concerning gratuity calculations and final settlements.

They provide essential assistance with contract review, helping clarify your employment terms and guaranteeing compliance.

In cases of disputes, such as unpaid gratuity or wrongful termination, skilled legal professionals can facilitate dispute resolution. They represent you in negotiations or in front of the Ministry of Human Resources and Emiratisation (MoHRE) or labor courts, advocating for your interests.

Additionally, they help employers guarantee that their HR practices align with legal standards, preventing potential conflicts.

Who Is Eligible for End-Of-Service Benefits in UAE?

Who qualifies for end-of-service benefits in the UAE? To be eligible, you must meet specific eligibility criteria set by the UAE Labour Law.

All employee categories, including full-time, part-time, and flexible workers, qualify for these benefits, provided you’ve completed at least one year of continuous service. If you’ve worked less than a year, you won’t be entitled to gratuity.

Your gratuity is calculated based on your final basic salary, excluding allowances like housing or transport. The calculation is proportionate to your service duration and working hours.

This means that even part-time employees are eligible for benefits, guaranteeing fairness across different employment arrangements. Understanding these eligibility criteria is essential for knowing your rights and entitlements when your employment ends.

Be sure to keep track of your service duration to guarantee you receive the benefits you’re entitled to.

What Is the Maximum Gratuity an Employee Can Receive in UAE?

While understanding your gratuity entitlements is essential, it’s equally important to know the maximum amount you can receive as an employee in the UAE. The maximum gratuity you can claim is based on your final basic salary and the duration of your service.

Under UAE Labour Law, the gratuity limits state that your total gratuity shouldn’t exceed the equivalent of two years’ salary.

For employees who’ve served more than five years, you’ll receive 30 days’ salary for each year beyond five, while those with less than five years earn 21 days’ salary per year.