Did you know that nearly 60% of individuals in the UAE struggle with accessing credit due to low credit scores? Building a credit score from scratch is essential for opening financial opportunities, regardless of if you are seeking a loan or a credit card. Understanding the steps involved can make a significant difference in your financial future. So, what are the key actions you can take to start this important journey?

Understanding Credit Scores in the UAE

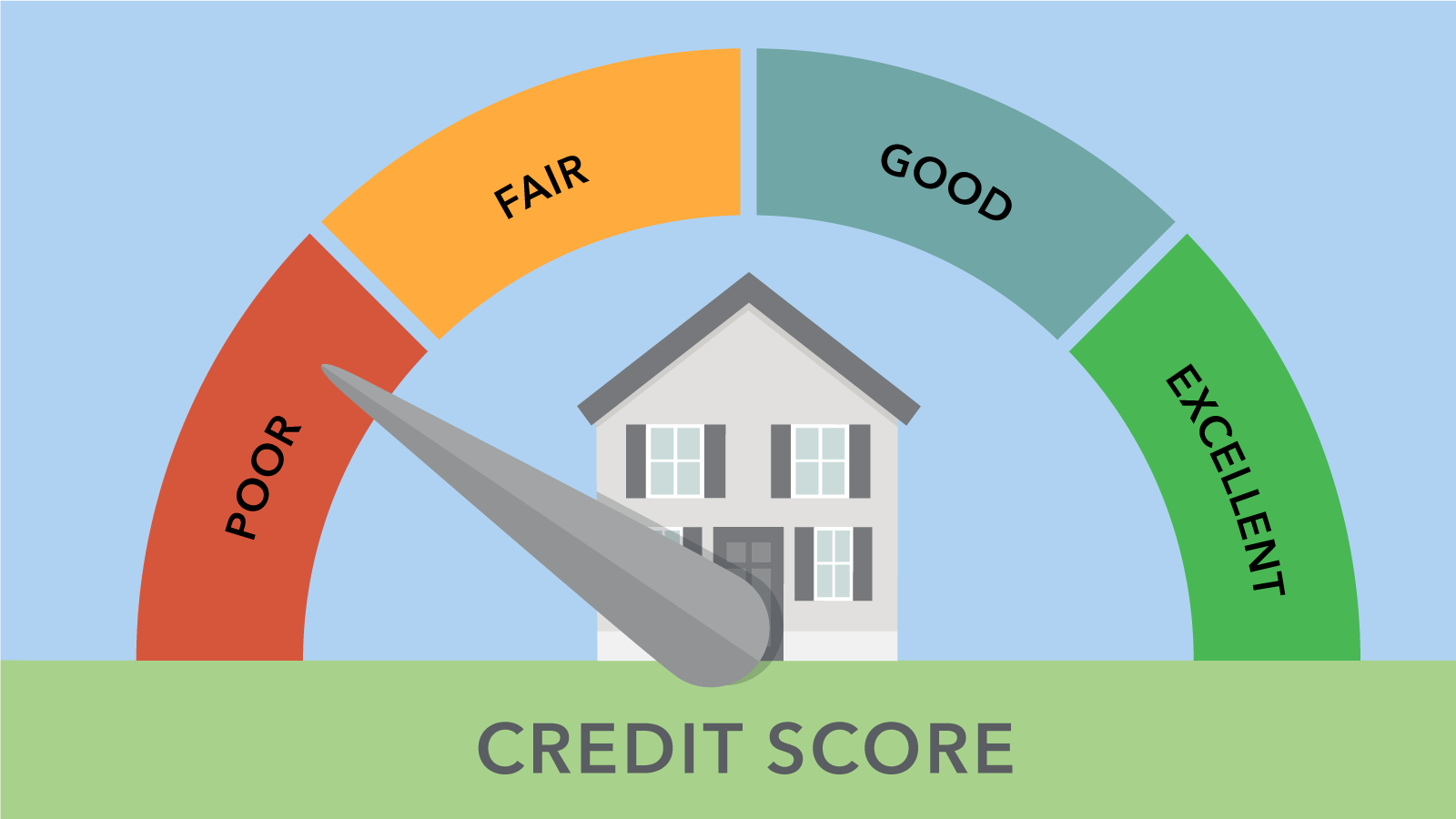

Understanding credit scores in the UAE is vital for anyone looking to make significant financial decisions, such as applying for a loan or renting a home. Credit score basics include the range of scores, typically from 300 to 900, where higher scores indicate better creditworthiness. In the UAE, your score is influenced by factors like payment history, credit utilization, and length of credit history. Improving your score requires a solid grasp of UAE financial literacy, enabling you to manage debts and obligations effectively. It’s important to regularly check your credit report for inaccuracies and guarantee timely payments. By understanding these fundamentals, you can navigate the financial landscape more confidently and make informed decisions that align with your goals.

The Importance of a Good Credit Score

While you may not realize it, having a good credit score can profoundly impact your financial opportunities in the UAE. A strong credit score demonstrates your reliability as a borrower, making it easier for you to secure loans, credit cards, or even rental agreements. Lenders view your credit score as a vital indicator of your financial health, influencing the interest rates and terms they offer. Without a solid score, you may face higher costs or outright denials, limiting your purchasing power. Furthermore, a good credit score can open doors to better financial products and services, helping you achieve your long-term goals. Ultimately, maintaining a healthy credit score is essential for maneuvering the financial landscape and enhancing your overall economic well-being.

Steps to Start Building Your Credit Score

To start building your credit score in the UAE, you’ll need to take a few key steps. Begin by opening a bank account and obtaining a credit card, as these are essential tools for establishing your credit history. Most importantly, make sure to make timely payments, as this will greatly impact your creditworthiness.

Open a Bank Account

Opening a bank account is a fundamental step in establishing your credit score in the UAE, as it lays the groundwork for building a positive financial history. Start by researching various bank account types, such as savings, current, or Islamic accounts, to find one that suits your financial needs. Each account type comes with distinct account benefits, including interest earnings, easy access to funds, and online banking services. By maintaining a well-managed bank account, you demonstrate financial responsibility, which is vital for your credit profile. Regular deposits and minimal withdrawals signal stability to lenders, helping you build trustworthiness. Ultimately, a solid banking relationship is essential as you begin your journey toward improving your credit score in the UAE.

Obtain a Credit Card

Once you’ve established a bank account, obtaining a credit card is a significant next step in building your credit score in the UAE. Credit cards come in various types, such as retail, secured, and standard cards. Each offers unique benefits, including cashback, rewards points, or travel perks.

| Credit Card Type | Key Benefits | Ideal For |

|---|---|---|

| Retail | Store discounts | Frequent shoppers |

| Secured | Credit building | New credit users |

| Standard | Flexibility and rewards | Everyday expenses |

Choosing the right card can enhance your financial profile and help establish a positive credit history. Make sure to evaluate your options carefully to maximize the benefits while keeping your financial goals in mind.

Make Timely Payments

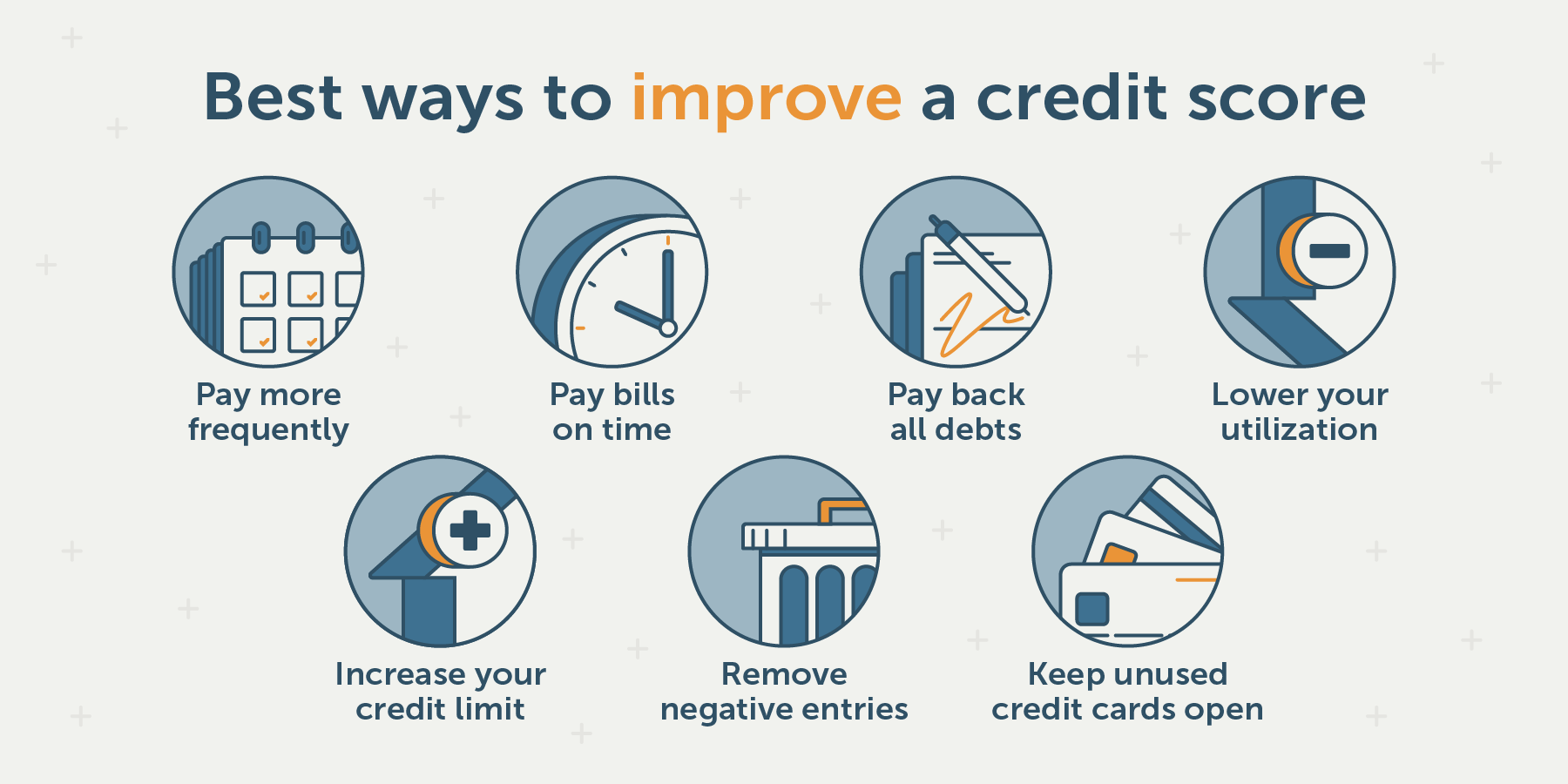

While building your credit score in the UAE, making timely payments is essential. Consistently paying your bills on time can greatly boost your creditworthiness. Here are some effective strategies to guarantee you never miss a payment:

- Set up payment reminders: Use your phone or calendar to remind you of upcoming due dates. This simple step can help you stay organized.

- Enroll in automatic payments: For fixed expenses, consider setting up automatic payments to guarantee they’re paid on time, every time.

- Review your statements regularly: Keep an eye on your billing statements to avoid surprises and guarantee accuracy.

Utilizing Credit Cards Wisely

Using credit cards wisely can greatly impact your financial health and credit score in the UAE. To guarantee responsible spending, monitor your credit utilization ratio, which should ideally be below 30%. This means that if your credit limit is AED 10,000, keep your outstanding balance under AED 3,000. Here’s a quick reference table to help you manage your credit card usage:

| Action | Impact on Credit Score |

|---|---|

| Keep balances low | Positive |

| Use cards regularly | Positive |

| Max out credit limit | Negative |

| Late payments | Negative |

Timely Payment of Bills & Loans

Since timely payment of bills and loans directly influences your credit score, it’s essential to prioritize this aspect of financial management. Consistently making your payments on time not only builds trust with lenders but also enhances your creditworthiness. Here are three key reasons to focus on timely payments:

- Credit Score Improvement: On-time bill payment and loan repayment contribute positively to your credit score, reflecting responsible financial behavior.

- Lower Interest Rates: A strong credit score may qualify you for lower interest rates on future loans, saving you money.

- Avoiding Penalties: Late payments can lead to additional fees and negatively impact your credit score, making financial management more challenging.

Monitoring Your Credit Report

How often do you check your credit report? Monitoring your credit report is vital for maintaining report accuracy and ensuring your financial health. Regular checks allow you to spot any discrepancies or unauthorized activities that could negatively impact your credit score. In the UAE, you’re entitled to one free credit report per year from the major credit bureaus. Take advantage of this to assess your credit history and identify areas for improvement. If you find errors, it’s important to dispute them promptly to maintain the integrity of your credit profile. By staying informed about your credit report, you empower yourself to make better financial decisions and enhance your score over time. Don’t underestimate the significance of vigilance in your credit journey.

Common Mistakes to Avoid

When building your credit score in the UAE, it’s essential to avoid common pitfalls that can hinder your progress. Ignoring payment timeliness and overusing your credit limits can greatly impact your score. By staying aware of these mistakes, you can better manage your credit health.

Ignoring Payment Timeliness

Although it might seem insignificant, ignoring payment timeliness can severely impact your credit score in the UAE. Establishing good payment habits is essential, as even one missed payment can lead to lasting harm. Here are three common mistakes to avoid:

- Missing due dates: Set reminders or automate payments to guarantee you never miss a deadline.

- Paying only the minimum: This can lead to increased debt and interest, affecting your overall financial health.

- Believing credit myths: Many think that late payments won’t affect their scores if they pay eventually, but that’s far from the truth.

Overusing Credit Limits

Overusing your credit limits can greatly harm your credit score, especially in the UAE, where lenders closely monitor credit utilization. Maintaining a low credit utilization ratio—ideally below 30%—is vital for a healthy score. If you consistently max out your credit cards, it signals poor spending habits and financial instability to lenders. This can lead to higher interest rates or even denial of future credit applications. To improve your credit utilization, consider setting monthly spending limits and tracking your expenses. Additionally, paying off your balances in full each month can help you avoid overextending yourself. Remember, a balanced approach to using credit not only strengthens your score but also promotes better financial health in the long run.

Long-Term Strategies for Maintaining a Good Credit Score

Maintaining a good credit score in the UAE requires consistent effort and strategic planning. To achieve this, focus on these long-term strategies:

- Monitor Your Credit Utilization: Aim to keep your credit utilization below 30%. This helps demonstrate responsible credit usage and keeps your score healthy.

- Practice Effective Debt Management: Always pay your bills on time. Late payments can greatly impact your score, so set reminders or automate payments.

- Diversify Your Credit: Consider a mix of credit types, such as credit cards and personal loans. This can positively influence your score by showcasing your ability to handle different forms of credit responsibly.